Senegal’s Mounting Debt Challenge

From 347 billion in 2012 to 1,826 billion in 2024, Senegal’s public debt has grown rapidly, putting a heavy burden on the country and posing concerns for its economic stability. This equates to a daily repayment of approximately 5 billion. The increasing debt levels pose a significant challenge to the country’s economic stability and future development. Public debt is a country’s financial liabilities requiring future interest and principal payments; it is often expressed as a percentage of Gross Domestic Product (GDP). This metric allows for comparisons across countries and provides insights into a nation’s debt sustainability, which is its ability to borrow more money.

Senegal’s public debt has steadily increased over the years. In 2006, the debt stood at 1,022.7 billion, equivalent to 20% of GDP. By 2012, this figure had risen to 2,741.4 billion, representing 40% of GDP. However, by 2024, the debt had decreased to 1,248.2 billion, resulting in a deficit of 3.9% of GDP.

Legal framework and current debt situation in Senegal

Public debt management in Senegal currently finds itself at a critical juncture, particularly marked by increased financial challenges following a recent change of government. The national debt has risen significantly, from 347 billion in 2012 to 1826 billion in 2024, representing an estimated repayment rate of 5 billion per day. In Senegal, public debt includes all liabilities that are debt instruments, i.e. financial claims that require payment(s) of interest and/or principal by the debtor to the creditor at some date in the future. Public debt is generally expressed as a percentage of gross domestic product (GDP).

This makes it possible to compare debt with the size of the economy, thus facilitating international comparisons. The debt burden has evolved gradually, from 1,022.7 billion or 20% of GDP in 2006 to 2,741.4 billion or 40% of GDP in 2012, and finally to 1,248.2 billion or a deficit of 3.9% of GDP in 2024.

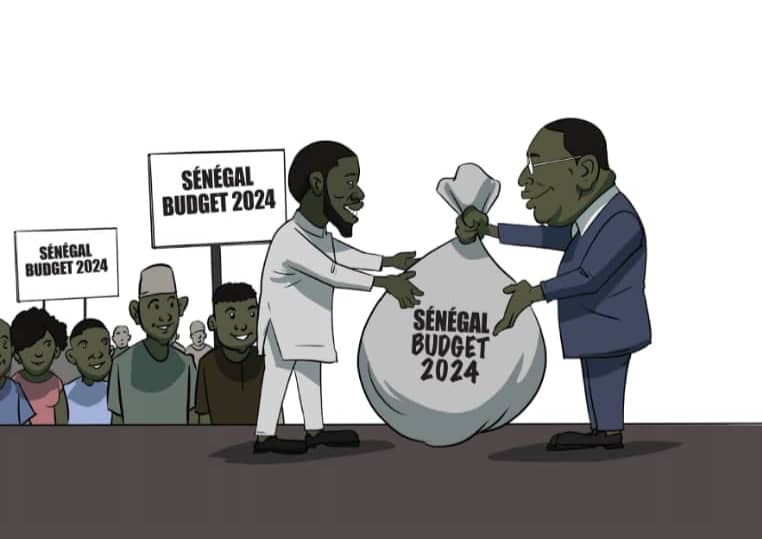

This underscores the need for the government to take strategic measures to stabilize public finances and stimulate economic development. In response to these challenges, budget adjustments for 2024 are jjn envisaged, aimed at boosting tax revenues and rationalizing public spending as part of more prudent management of future borrowings.

With regard to the West African zone to which Senegal belongs, Regulation n°09/2007/CM/UEMOA, establishing a reference framework for public debt policy and debt management in UEMOA member states, stipulates that public debt refers to domestic and external loans contracted directly by the State, domestic and external loans contracted by state entities, and public and private loans guaranteed by the State or its entities. Every year, debt servicing is one of the most important items.

The major challenges of public debt management in Senegal

According to World Bank data, Senegal’s public debt will have reached around 73.4% of GDP in 2023, compared with 61% in 2020. This increase is mainly due to borrowing to finance infrastructure projects such as the Regional Express Train (TER) and the new Blaise Diagne International Airport, as envisaged in the then government’s Senegal Emergent Plan. External debt represents around 40% of GDP and is mainly contracted in foreign currencies, exposing the country to exchange rate fluctuations.

Repayment capacity is another major challenge. By 2023, debt servicing will represent around 25% of government revenues, limiting the government’s ability to finance other essential expenditures.

In addition, debt payments reduce the funds available for social spending and infrastructure investment. Rural infrastructure projects and social programs are underfunded due to debt payments. This results in delays in improving living conditions for citizens, particularly in rural areas.

Another undeniable fact is that, to maintain debt servicing levels, the current government may be forced to raise taxes, which could slow economic growth. Indeed, higher taxes on business could reduce private investment and slow job creation.

The heavy burden of debt servicing on the general government budget has a crowding-out effect, making it difficult to finance investments in the future. These basic social service sectors find themselves relegated to a level of financing far below their social or economic importance. Senegal’s budget deficit in the 2024 Finance Act stands at CFAF -840.2 billion, or -3.9% of GDP. Financing future investments remains a major issue for Senegal. The DPBEP (June 2024) for the period 2025-2027 points to a central government debt of around 13,772.8 billion Fcfa, compared with 11,782.8 billion in 2022. The high level of interest and commissions associated with the public debt (578,273,618,000 FCFA in 2024) and the high level of capital (882,990,275,799 FCFA) and current transfers made by the State drastically reduce the latter’s investment capacity (953,281,294,201 FCFA).

Public debt policy and development vs. financing future-oriented spending on education, health, justice, climate and research.

The relationship between public debt and a country’s development ambitions is highly dependent on political options and macroeconomic and macro-budgetary programming. If public debt rises excessively, a country runs the risk of being unable to meet its interest charges, and may find itself in a situation of public bankruptcy. This relationship is twofold, as it presents both a picture of the factors destabilizing debt policy and avenues for rehabilitating the effectiveness of debt policy at the service of development.

Over the past three years, Senegal has been shaken by a series of adverse shocks that have altered its solid fundamentals and the momentum of its reforms. As a result, a number of reforms planned under the previous IMF-supported program remain unfinished, namely: i) broadening the tax base, ii) eliminating energy subsidies, iii) strengthening social safety nets, iv) correcting deficiencies in the AML/CFT system, and iv) implementing structural reforms conducive to job-creating, private-sector-led growth.

The immediate manifestation of the crowding-out effect of debt servicing on the financing of investments for the future is the scissor effect, which threatens the sustainability of the deficit and the balance of public accounts. The relationship between public debt and the efficiency of investment in priority sectors is becoming difficult to establish. The share of basic social service sectors in the general State budget remains very low: Health (n°3 of the OECD Sustainable Development Goals) and Education (n°4 OECD SDG) represent less than 20% of the general State budget. And PBO data show that only 11% of debt is used for health, compared with 21% for agriculture and 30% for transport.

Public debt and changing professions: training and employment in the extractive industries, digital technology and artificial intelligence.

Debt policy in these times must reflect the public finances of the time: intelligent, forward-looking, coherent and resilient. It must serve as an efficient, streamlined financing lever to support public action efforts, by better gearing public spending towards responding to the various transformations shaking the State (contrary to the incongruities attached to public intervention by the followers of the Chicago School of Public Choices or the political economy ideologies long propagated under Donald Regean and Margaret Thatcher, making public spending, and therefore the State, “the problem, not the solution”). To this end, in 2009 the World Bank and the International Monetary Fund drew up a systematic and exhaustive Framework to help countries formulate an effective Medium-Term Debt Management Strategy (MTDS).

The dematerialization of certain administrative functions and the procedures that accompany them threaten thousands of jobs, and call for the acquisition of new knowledge and skills. Taking charge of such innovative fields calls for massive public investment. The problem with public debt, however, is that in many cases, as is often the case in Africa, repayment calls for over-indebtedness in order to refinance the debt, or simply to formulate requests for cancellation. COVID-19 and the Russo-Ukrainian crisis have amply demonstrated the precariousness of our repayment capacity. African economies, like Senegal’s, are characterized by their cyclical structure, which makes them particularly extroverted, fragile and vulnerable to exogenous shocks. And, as we know, investment in the digital and hydrocarbon sectors requires the training of qualified human resources and employable human capital.

The new government seems to be announcing some strong guidelines: the implementation of regular audits to identify and eliminate inefficiencies, and the adoption of a more prudent strategy for the management of new loans, ensuring that they are used to finance projects with a strong economic and social impact.

Elhadj Amadou Samb

BudgIT Senegal Country Lead